GST returns are due to be submitted by the 28th day of the month following the end of the reporting period and the payment deadline is the same as the return filing deadline. The same registration rules apply to both resident and non-resident businesses carrying out taxable activities. These are the taxes you might be expected to pay as a tourist or international visitor to New Zealand, which we will go into debt yield calculator hud loans more detail about in this New Zealand tax guide for travellers. In New Zealand, goods and services tax (GST) is a tax added to the price of most goods and services, including imports, and is charged at the standard rate of 15%.

Visa-waiver countries for New Zealand are listed in What You Need to Know About the New Zealand ETA & Visitor Levy. A limited number of duty-free stores outside of the airports do this, which transactions 2021 we outline in our complete guide to Duty-Free Shopping in New Zealand. Almost all of the time, businesses will include GST in the price displayed. However, some businesses will write a price and mention “+ GST” which means that you should add the GST to that price to know how much the price is in total. This is pretty rare but still happens in some trade, wholesale retailers and services, so keep an eye out.

As a GST-registered business, you can claim back the GST you’re charged on goods and services you buy and use in your taxable activity. For GST-registered businesses, a GST return is due by the 28th of the month after the end of the taxable period. However, if the reporting period ends on November 30, the return and payment must be submitted by January 15 of the following year. The new rules replace the requirement to use tax invoices with a more general requirement to provide and keep certain records known as taxable supply information. The new rules set out the minimum set of records required to support the figures in your GST returns.

New Zealand Arrival and Departure Tax

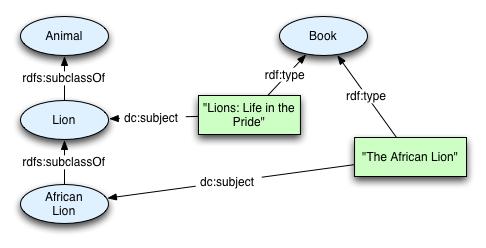

This is similar to VAT, and based on the OECD’s standard indirect tax regime model. It is one of the most progressive regimes in the world, with a wide base and limited exemptions. Our handy online tool will help you decide on the records you need to keep when you buy or sell goods or services.

The Goods and Services Tax (GST) in New Zealand

- There is no upfront cost to pay for these fees, they are included in the cost of your travel ticket.

- The IVL is said to be “a way for travellers to contribute directly to the tourism infrastructure they use and to help protect and enhance the natural environment”.

- Because GST is a tax on all goods and services, it will be applied to almost everything you purchase in New Zealand.

- A limited number of duty-free stores outside of the airports do this, which we outline in our complete guide to Duty-Free Shopping in New Zealand.

Returns and payments are due to the IRD by the 28th of the month following the end of the return period. You may not realise it, but an arrival and departure tax is added to the cost of your flight or cruise ticket to and from New Zealand. The arrival and departure tax for New Zealand, also known as “border processing levies”, is a fee to pay for the Customs and Biosecurity procedures you go through upon arrival and departure. There is no upfront cost to pay for these fees, they are included in the cost of your travel ticket.

Speak to our Experts about your Domestic VAT Reclaim potential today.

Additionally, there are a couple of visitor taxes for New Zealand, such as the NZETA and IVL, that you will have to pay an upfront cost for. They will need their business industry classification (BIC) code, and know which taxable period applies to them and which accounting accounting basis they want. When you import the goods, you’ll likely be charged GST by Customs as they come into New Zealand. You can claim this amount back if you’re GST registered and are using the goods solely to make taxable supplies. The IRD imposes a 1% monthly penalty on unpaid amounts and interest charges on outstanding balances.

You can use any format or method to provide taxable supply information, if it contains the required notes payable information and is easily accessible by Inland Revenue. You can also use eInvoicing, which is a secure way of exchanging invoices electronically between businesses. You can choose to file your GST returns monthly, two-monthly or six-monthly. Most small businesses choose to file two-monthly or six-monthly GST returns. The filing frequency affects how often you must pay or receive GST, as well as how much paperwork you must do.

He is an expert in New Zealand travel and has tested over 600 activities and 300+ accommodations across the country. You must request and pay for an NZeTA before you travel to New Zealand. There are two ways of paying for the NZeTA and IVL, either through an Immigration New Zealand app or their website.